Small banks need to plug the data gap

Banking, along with many other industries, is racing toward a future driven by artificial intelligence. AI-related technologies are projected to save banks billions annually within the next half decade. Those that best harness these technologies and their benefits will gain a competitive advantage.

That should worry community and regional banks. Machine learning and deep learning solutions, which are driving much of the technological advancements in AI in recent years, require large volumes of data to train and fine-tune for market. In the age of AI-driven banking, this will give a significant advantage to the largest institutions with the most users and thereby the most data. This will enable megabanks to deploy more AI-based services than smaller competitors, and their solutions will be more effective and accurate with more training data.

To compete, community and regional banks will need to access greater volumes of data. Megabanks can simply harvest the data their customers provide by using their products and services, but smaller banks will need to get more creative. This will require exploring third-party data sources and leveraging data-sharing agreements, as well as considering new technologies that can alleviate this problem for smaller institutions.

Of course, many financial institutions have been purchasing data from third parties for years, but the increasing importance of AI technologies will likely drive renewed focus on third-party data. Purchasing data from data brokers or other entities can help smaller banks overcome their data scarcity and attain new insights.

For instance, Wescom Credit Union combined historical customer data with data from third-party sources to build individualized profiles for each of its members. Those profiles are then used to personalize timely marketing offers and recommendations based on recent activity.

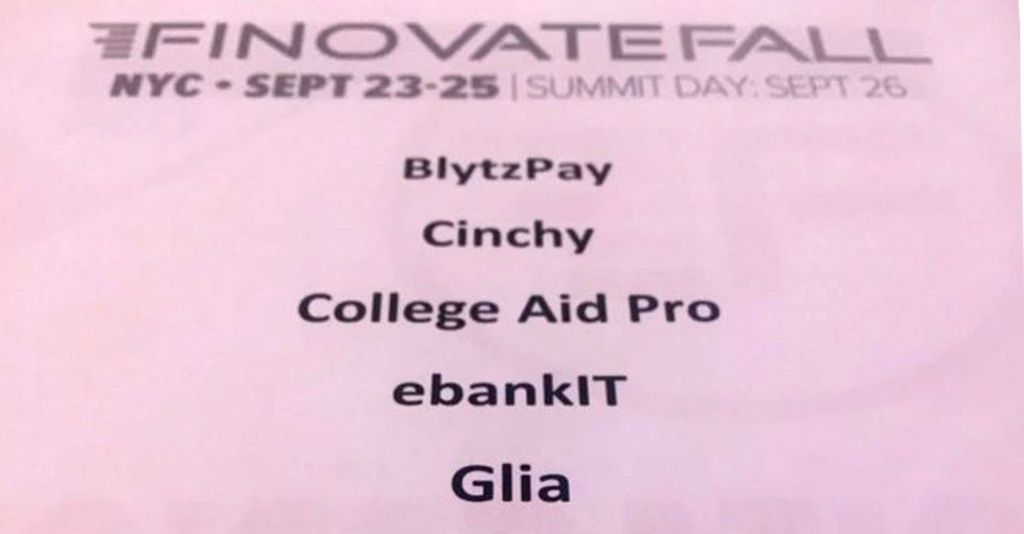

Banks looking to acquire more external data can also turn to new sources. For instance, online data marketplaces are proliferating and growing more diverse in the types of data and sources they offer. Gartner has predicted that 25% of large enterprises across industries will be buying and selling data on such marketplaces by next year. Smaller banks should try to get in on the action too — in order to even the playing field.

Keep reading on American Banker.

Subscribe to CCG Insights.