Fintechs Facing Bank-like Challenges as They Evolve Beyond Roots

An argument has been circulating through financial services for some time, running like this: Traditional banking institutions are producing too many products, and can’t hope to compete with fintech specialists focusing on just one product. This thinking has led to the creation of a few tremendous successes, such as Wealthfront and Betterment in the wealth management space.

But is this really where things are headed? Let’s examine the reasoning of supporters and opponents.

Viewpoint: Traditional Players Can’t Do It All Anymore

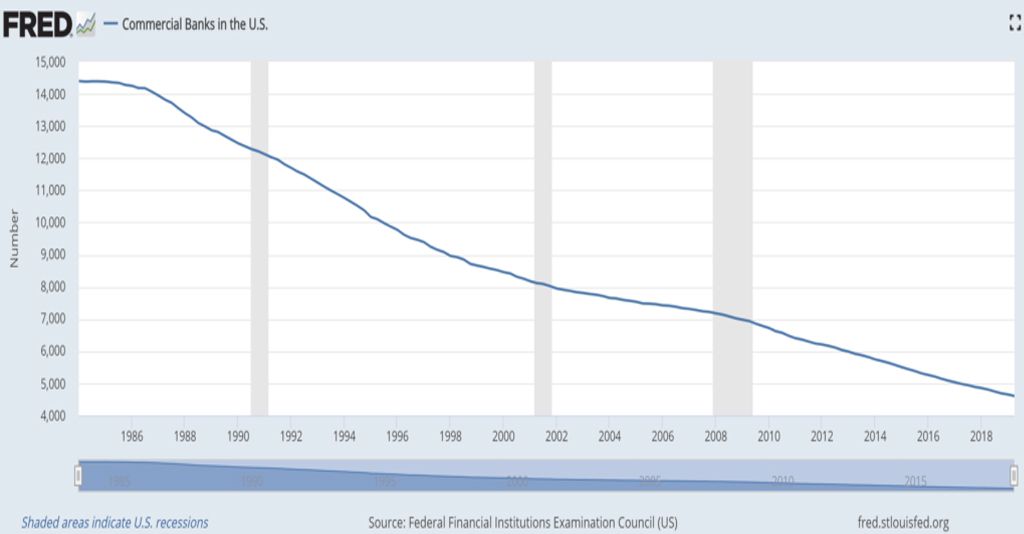

The key argument was forcefully put forth last year by Frank Rotman, a partner at QED Investors. He wrote: “There are many full-service banks and credit unions today, most of which are too small to deliver a suite of products profitably.”

And further, he wrote, “Share will increasingly become concentrated in the hands of best-in-class product providers as channel barriers fall and information becomes more abundant.”

Most industries, Rotman said, split manufacturing from distribution years ago. The company that manufactures hammers does not sell them directly to the consumer — the consumer goes to the hardware store or home center, or orders them on Amazon because they get free shipping. Movie studios no longer operate their own theaters.

So, the argument runs, banking should follow this model. Some institutions will be factories, others distributors. Both cases involve working with fintech and big tech companies.

Further, this argument holds, traditional generalist institutions should specialize, because no institution, particularly smaller ones, can produce best-in-class products across the numerous product lines that banks and credit unions serve. To thrive, financial institutions must find their unique place in the market. Fintech specialists that build one product superlatively can opt to distribute them through the banks and credit unions or other corporations that have large bases.

Specialist banking institutions may be better positioned to thrive than small generalists, just as fintech providers are better served finding consumers where they are already concentrated — at traditional players.

But Financial Services Aren’t Hammers

There’s some appealing logic to this argument. But does it hold true in a digital age?

Increasingly, digital approaches are undermining the idea that manufacturing and distribution must be separated. Digital channels allow for low-cost marketing and distribution efforts. Netflix and Amazon Prime Video serve as strong examples. They both not only stock huge libraries of shows, but have become movie and show producers that also exclusively distribute their own products. Makers of everything from automobiles down to energy drinks can offer these products direct to consumers these days.

Doing business this way could work to the benefit of digital banks, as the success of challenger banks in the U.K. and Europe is beginning to show.

But a Tesla is highly differentiated. How different is your institution’s savings account from all the others out there?

Keep reading on The Financial Brand.

Subscribe to CCG Insights.