Do You Own the Power Plant?

Years back, the organization I worked for acquired a major mortgage company. This company, which had fallen on hard times (read: financial crisis) had not invested much capital in the IT area. The data center was extremely outdated and in need of a total rebuild.

Our CEO told me that she would get me the necessary capital to build a brand-new data center from scratch. I started to act on this, then stopped and said, “Why?” Why build this engine, this furnace for the house, when we can rent it via outsourcing? This idea was met with great resistance: We can’t give that away! We will get you the capital and build our own!

While availability of applications and services for customers is always paramount, how many consumers pick a financial organization on the capability of their “power plant,” the data center? Users, both internal and external, take it for granted.

I visited the CEO, PowerPoint in hand, determined to make the case on why we should outsource the entire data center, but on the way, I had a realization. I never used the PowerPoint. Instead I asked her, “The lights in your office are on — does it bother you that you don’t own the power plant that generated the electricity?” I continued the analogy: You come in every day, flip the switch, the lights always go on, and you pay the bill monthly. The power company performs all the tasks necessary to make that happen and they incur the cost of capital to keep things maintained and updated.

I was given permission to proceed on outsourcing. 18 months later, over 280+ applications migrated without any internal and external disruption, and a three million dollar a year run rate savings on the go-forward operating expense, AND — no use of capital by our organization.

Why do I recall this story? Fast forward to 2019 and way too many community banks are running pieces of IT infrastructure in-house that would be better supplied by a 3rd party as a “managed service.” There are many reasons behind this rationale.

- The value of IT dollars

A recent McKinsey study showed that banks spend between 4.7 and 9.4 percent of operating income on technology, while airlines spend just 2.6 percent. According to a Celent study, money going for new investments accounted for only 27 percent of bank IT spending. The rest, an enormous 73 percent went towards “keeping the lights on.” At a time when digital is a priority and the industry faces disruption from fintech entrants, would not the IT dollar be better spent on accretive and innovative initiatives?

Many community banks don’t employ a Technology Lifecycle Policy. Best practice here is to “refresh” major components of the hardware stack at least every three years. Failure to do this, allowing hardware and infrastructure to become outdated or reach end-of-life, will require a major capital spending event and a much more difficult upgrade path.

- IT talent and centers of excellence

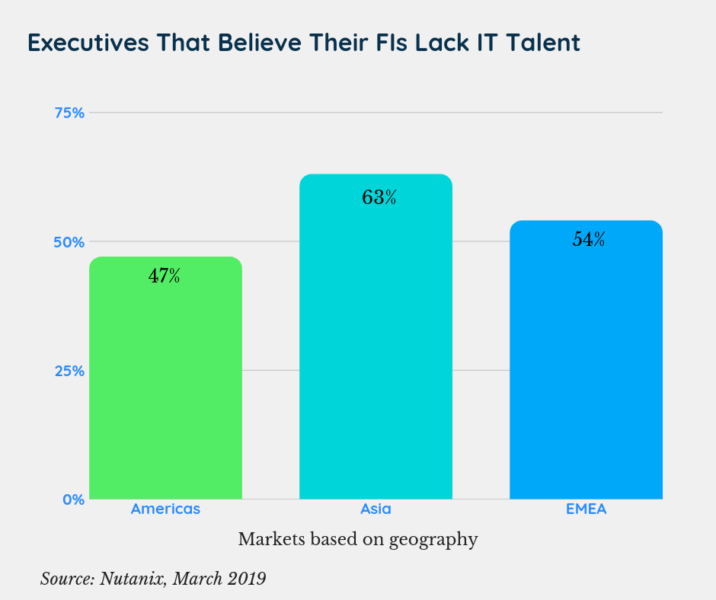

The industry is experiencing a shortage of IT talent.

This is particularly acute in banks residing in non-urban markets. 3rd party providers can better attract talent and have a higher degree of retention. Creating centers of excellence with highly skilled individuals is especially important in fast-changing areas such as cybersecurity, data analytics, AI, “open APIs,” etc.

- Reliability and Support

Managed Service providers, given economies of scale, will provide a higher degree of reliability, thus reducing downtime, than in-house solutions. In a digital banking world, these firms would also provide 24×7 support for IT services. Your managed IT infrastructure will ensure that when you do deploy new applications and capabilities for your customers, they will be RASP; [Reliable, Available, Scalable, Predictable]

- Innovation

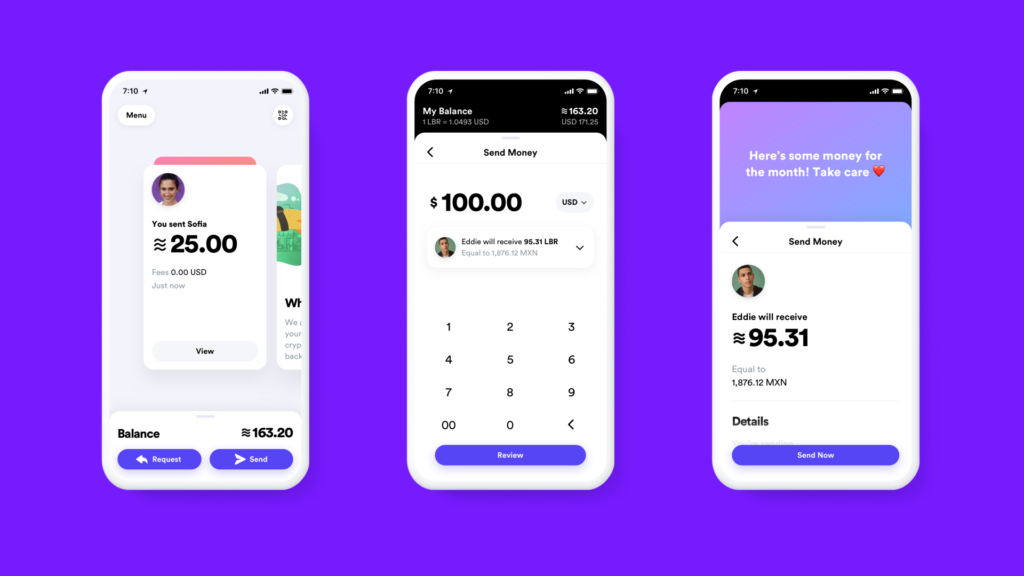

Every day we read about the drive to “digital transformation” in its many definitions and deployments. This transformation is occurring at the application layer of bank software and services. This is appropriate in the current environment. However, many infrastructure transformations have been occurring behind the scenes, including technologies such as software-defined wide area networks, hyper-converged data center architectures, etc. While focusing on the “application” side, most community banks would not have the time, budget or expertise to leverage these powerful new infrastructure developments. One could argue that even if you get the consumer digital omni-channel layer correct, it would be not leveraged to its fullest potential without some of these new digitally enabled infrastructures.

The above benefits and rational do come with items that need to be acknowledged, accepted, and addressed up front in the outsourcing process.

- Possible Lack of Transparency

It is critical that you have an assigned service delivery manager for your organization. In addition, you should have access to their real time monitoring systems and streamlined notifications processes for all “events”. There should be contracted deliverables around reporting on established Service Level Agreements.

- Project Impacts

As the organization is freed up to focus on accretive application activities, it will require better planning on implementations. It should be noted in the contract if there are “fixed” windows and processes for introducing new capabilities to the environment.

- Changing role of internal IT resources

The IT organization will not be fired when certain operations are outsourced. Instead, the existing group needs to focus and hone their skills on vendor management, 3rd party risk assessment and project management/coordination.

One of the key items in gaining the benefits of IT managed services is ensuring that the contract is extensive and comprehensive. This will avoid any hidden future fees, or missed expectations about service levels, technology lifecycle periods etc.

These challenges must be acknowledged and confronted, but they will be outweighed in most cases by the efficiencies that come with outsourcing.

So, while your outsourced “power plant” provides 24×7 RASP capabilities, you can use your critical IT resources and budgets towards accretive activities that attract and maintain customers in this digital age.

Subscribe to CCG Insights by CCG Catalyst.