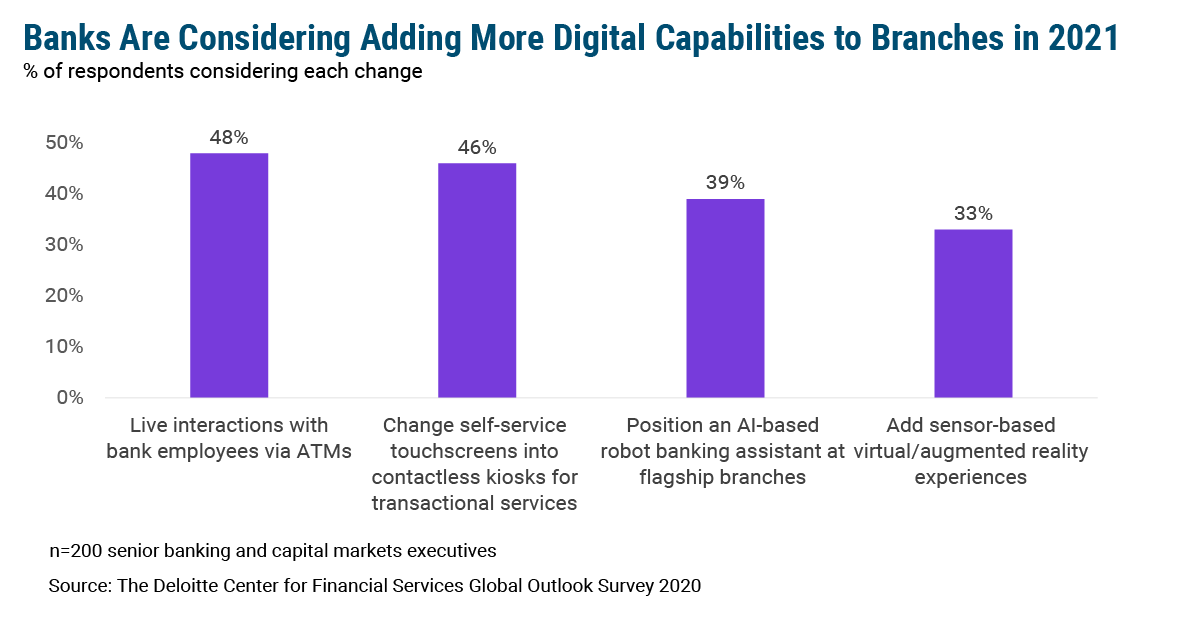

Banks are considering adding more digital capabilities to their branches in 2021, according to Deloitte’s recently released banking and capital markets outlook for the year ahead. Nearly half of global bank executives surveyed this summer said they are considering offering live interactions with bank employees via ATMs, while a similar percentage may change self-service touchscreens into contactless kiosks for transactional services. Other capabilities the survey asked about include AI-based robots in branches and virtual/augmented reality experiences.

The urge to bring the branch into the future makes sense, especially in light of the Covid-19 pandemic, which has put a spotlight on digital capabilities. But organizations should be careful not to over-primp their physical locations with features customers don’t want or need. While branches may generally benefit from modernization, it’s important to have a strategy behind any major changes. For example, when was the last time you had difficulty at an ATM that required talking to a branch employee? It probably doesn’t happen that often. And customers might be reluctant to engage on video for other matters that do require person-to-person interaction in such a public way. Contactless kiosks, on the other hand, could be a welcome addition, making people feel safe in a time of great uncertainty.

Any investment in technology should be weighed against its strategic value. And, while it’s certainly possible that respondents are loosely considering these capabilities, the data serves as a reminder that executives should be carefully assessing who their customers are and what they want before diving into new tools and services. Otherwise, they risk investing in technology that will yield little in the way customer satisfaction — for instance, in a recent survey of 1,123 US consumers by Coconut Software and WBR Insights, just a third of respondents expressed interest in video tellers/smart ATMs, signaling there may be a mismatch between what executives think their customers want and what they’re actually looking for. The desire to improve the customer experience at the branch is a reasonable one; the first step, though, should be understanding customers, their journeys, and most importantly, their pain points.