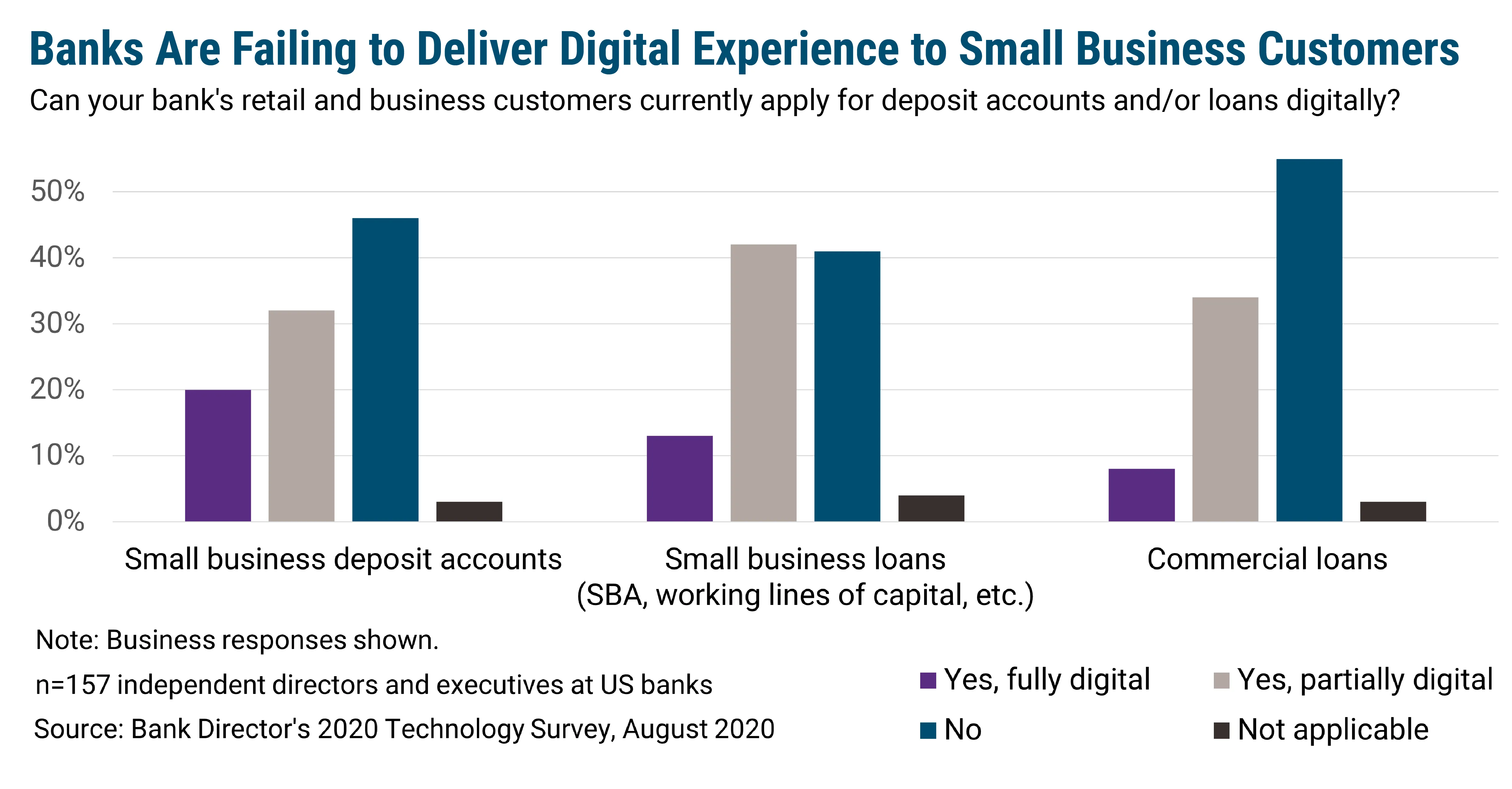

Banks Are Failing to Deliver Fully Digital Experiences to Business Customers

While the pandemic continues to bring renewed focus on digital transformation among financial institutions, this fervor has yet to drive substantiative change within the commercial banking realm, according to Bank Director’s 2020 Technology Survey. Not even a quarter of US banks surveyed can open deposit accounts for small businesses fully digitally, and just 13% say small businesses can apply for loans this way. Meanwhile, the outlook for corporates is even bleaker, with only 8% of respondents saying customers can apply for commercial loans through purely digital channels. The survey was fielded in June and July of this year, after many banks had already accelerated their digital plans and made significant changes to better serve customers and employees at home.

The results here are a bit disappointing, especially as small businesses have been some of the hardest hit during the COVID-19 crisis. These companies are in need of access to financial services, and especially capital, and being able to apply digitally is key. In comparison, 42% of respondents say retail customers can open accounts digitally, and 30% say they can apply for loans. This adds to evidence that the small business segment in the US is underserved by traditional financial institutions; three in five small businesses surveyed by Aite Group for Alkami in 2019 said they had to venture outside of their primary institution to access the financial services they need.

The outlook isn’t all poor, though. A whopping 70% of respondents to Bank Director’s survey reported implementing or upgrading technology to support the Paycheck Protection Program (PPP), which set aside $659 billion in government funding to provide relief to small businesses in the form of forgivable loans. This likely contributed to 42% saying they can now provide some level of digital support for small business lending. With time, and as these banks build on the foundation spurred by PPP, we could see more of a shift to fully digital operations from these players. In particular, we can expect to see banks that partnered with fintech providers to speed up their lending processes deepen those relationships. It is on these institutions to resist the urge to let up on the gas, though, and turn their recent efforts into wholly digital channels. Otherwise, they risk attrition — half of the small businesses surveyed by Aite Group believed they would at least consider switching financial providers in the next two years.