When Customers Say Adios!

Customer attrition is a painful problem for financial institutions. The acquisition process for new customers is costly and does not solve the attrition problem.

No matter how many customers respond to your net promoter survey about their experience with your financial institution, NPS does not explain the whole story. To

Customers have many financial institution choices to conduct their banking. The research points to many reasons, frustrations, challenges, and trigger points of customers who switched their bank or credit union.

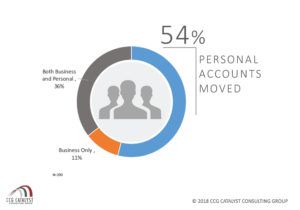

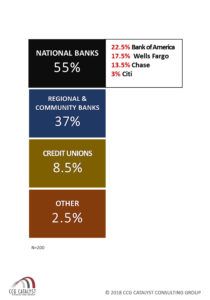

National banks incurred the greatest number of customers switching, while credit unions had the least number of customers leaving. Customers [55%] who left their national bank sought other types of financial institutions to conduct their banking. National banks that were mentioned the most by customers included Bank of America, Wells Fargo, Chase, and Citi.

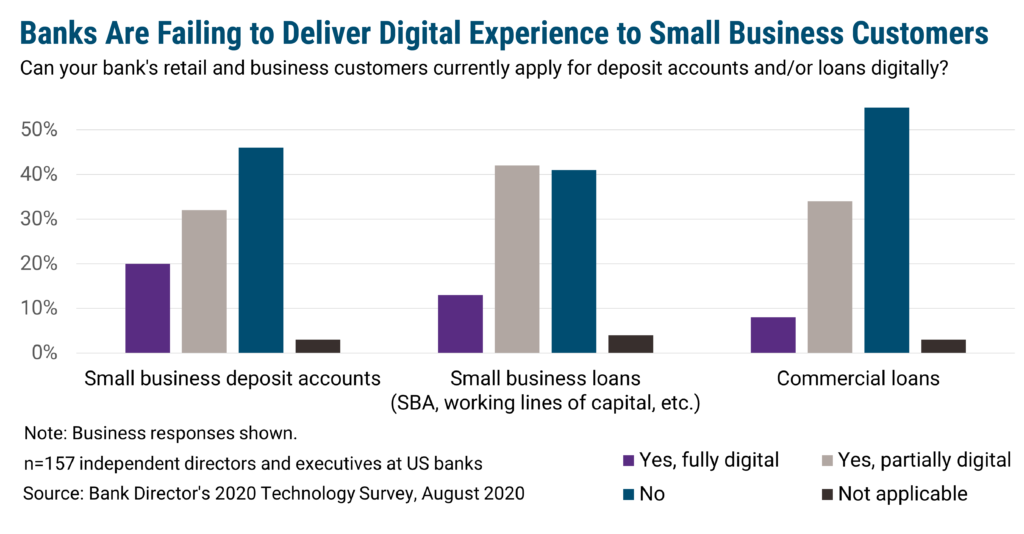

Business customers complained the most about the lack of a banking relationship and advice to help them grow their business.

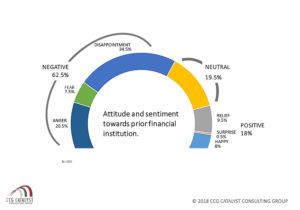

More than half the customers expressed negative attitudes and sentiments toward the former financial institution. After leaving their primary FI for a new financial institution, 84% of the customer who expressed satisfaction.

Asked to describe their challenges 63% said customers had problems with products, service, and channels. In their discussions, 60% talked about needs and ethics as trigger points. Convenience and trust two key elements to keeping a relationship with the customer.

The full report provides 47 pages of analysis and insights of 200 bank or credit union customers who switched their bank or credit union for another financial institution. We codified the reasons, frustrations, challenges and trigger points of customers, and transformed the analysis into recommendations.

Report Contents

- Executive Summary

- The Exploration

- Purpose and Methodology

- About the Customers

- Challenges

- Expectations of New Bank

- Deeper Look at Customers

- Comparisons

- Insights

- 39 graphs and several images, 2 circular histograms

- Customer comparison profiles

Questions regarding the study and to obtain the full report, Why Customers Switch Their Bank or Credit Union, contact marketing@ccg-catalyst.com

Subscribe to CCG Insights.