The U.S. Has Lost 184 Banks This Year

Banks are disappearing from the U.S. at the rate of 0.7 per day — 183 banks have been acquired (and one has failed) so far this year, according to data from S&P Global. 88 credit unions have also disappeared in 2019.

“So what?” say fintech enthusiasts. America has too many small banks anyway, and these banks have little money to spend and no ability to innovate, so to the dustbin of history with them. But for anyone looking to sell to banks and credit unions, a shrinking marketplace should be cause for concern, and for the remaining banks and credit unions, it’s an uncertain time.

The major cores realize this, and their business is increasingly shifting to payments, as was seen in the FIS-Wolrdocm and Fiserv-First Data acquisitions earlier this year. Transactions and deposits are increasing, even as institutions go away, and this is happening alongside a boom in fintech startups. Rough estimates put the number of fintech startups at 10,000, about the same number as the combined number banks and credit unions in the U.S.

Community banks were part of a wave of services to less settled areas, arriving not long after other trappings of modernity like paved roads and electrification. A number of U.S. laws preventing interstate banking led to many small institutions centered on particular regions, and while often undiversified and vulnerable to local crises, these banks also delivered unprecedented prosperity to Americans in the form of credit and secure deposits, and remain so today for many communities.

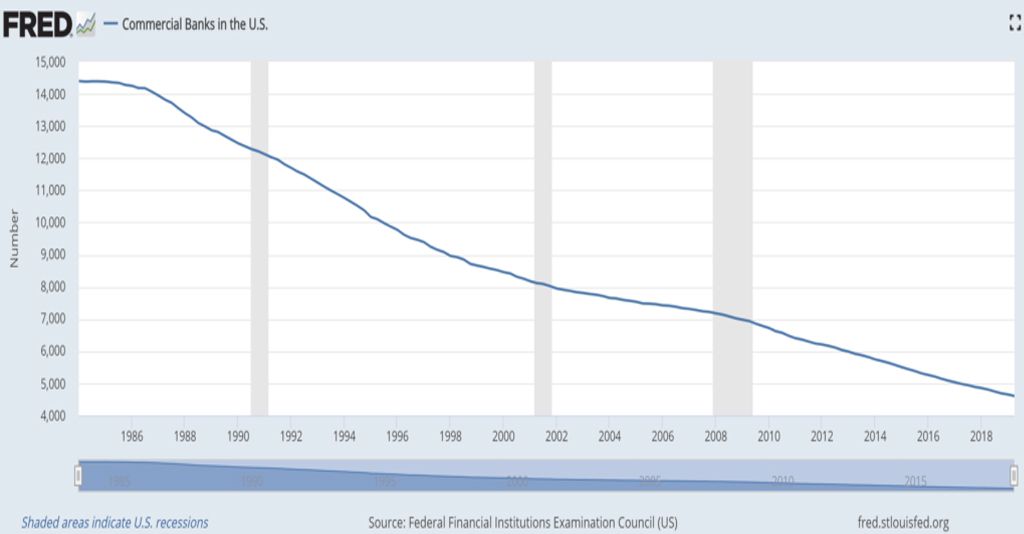

Yet they are steadily disappearing. and those that remain hold a shrinking share of deposits. In 2009, there were about 6,800 banks, and today there are about 4,600. From the 1930s and the creation of the FDIC, until the mid-1980s, there was a steady number of about 14,000 banks. The decline has hardly slowed since it began with the S&L crisis, but community banks are always the hardest hit.

This is unfortunate for the industry at large and particularly for their communities, as losing a bank can accelerate a rural area’s decline. They are also great potential partners for fintech startups, and have the existing customers bases, if not necessarily the in-house tech talent, to test products. As headcounts shrink, there will also be an exodus of talent from the industry.

But even if banks are going away, new banks are coming, right? Sort of. There have been nine new charters so far in 2019 (up from six in 2018 and four in 2017), plus a number of new challenger “banks” offering banklike services backed by a chartered institutions. Funding to these banklike challengers has been abundant, showing investor appetite for new banking offerings. While there is promise here for customers, the industry is still hemorrhaging institutions and talent that will increasingly look to technology for jobs.

Community banks, meanwhile, must look for ways to continue serving their far-flung customers. As branches disappear, many communities will be forced to rely on nonbank lenders and quasi-financial institutions like Walmart in order to get banking done. But the banks themselves can serve these customers digitally, if they invest in mobile banking. 90% of rural residents in the U.S. own smartphones, and are as active in social media and m-commerce as urban counterparts.

The larger banks are turning to automation to create millennial and Gen Z-friendly experiences. Smaller banks can offer similar if not equivalent experiences. There are fintech startups today that are willing to offer their service for low or no costs just to prove the concept. Because branch visits are less convenient in rural areas where they are sparse than in large cities where they are abundant, mobile is relatively more valuable to rural customers. Even older customers are habituated to the mobile experience, so an aging customer base should not hold back investment in mobile.

As the industry contracts, fintech vendors should look to support these institutions, who form the bedrock of their businesses, and the institutions themselves must get creative about how to serve the customers they have and be competitive enough to gain more.

Banks and fintechs need each other on existential level. The fundamental question in any romantic comedy, according to the director Billy Wilder, is what keep the lovers apart. Banks and fintechs should consider the same question.

Subscribe to CCG Insights.