Mobile Payments Will Rule POS in Ten Years’ Time, Experts Say

The financial services industry is bullish on mobile payments.

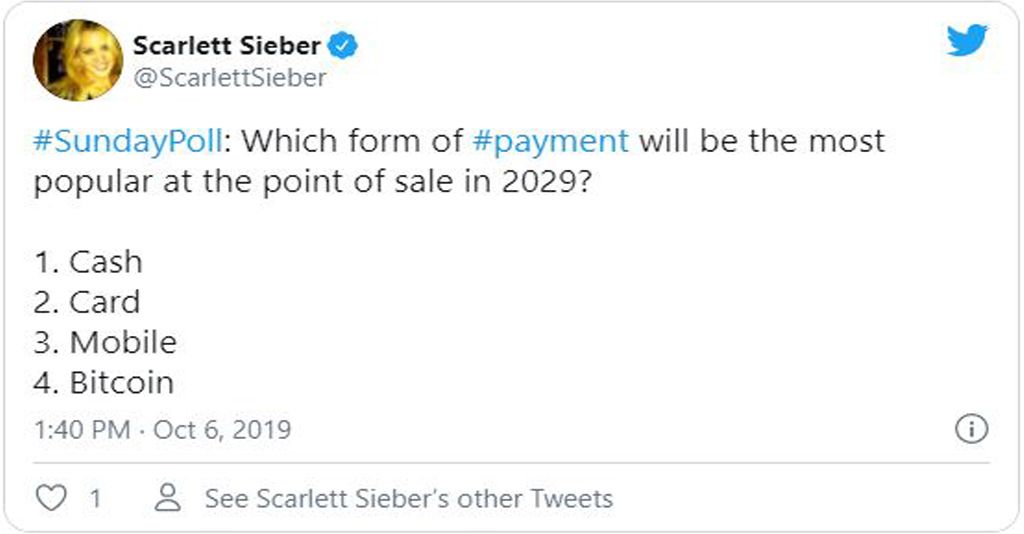

2029 may be a long way away, but everyone has opinions about shopping — especially fintech watchers. In a recent Twitter poll on methods of payment at the point of sale ten years from now, mobile won the day, but opinion was far from unanimous. Several respondents pointed out that geography plays a major role, mobile being more advanced in many countries outside the United States.

CCG Catalyst’s Scarlett Sieber posed the question:

#SundayPoll: Which form of #payment will be the most popular at the point of sale in 2029?

1. Cash

2. Card

3. Mobile

4. Bitcoin— Scarlett Sieber (@ScarlettSieber) October 6, 2019

Founder of Moven and Futurist Brett King answered that mobile is already the most popular form of payment globally – though things change so quickly that’s no guarantee it will still wear the crown in 2029. King is pointing to China in particular, though mobile is also more popular in his native Australia and Europe. Shamir Karkal, a founder of Simple and now payments API firm Sila, wanted to get more specific: “Mobile for sure. But which app/ network?”

Adam Finke, senior manager; consumer lending partnerships at MetaBank, said that though mobile will be the fastest growing payment method in ten years, cards will still rule the roost, thanks to the mix of debit and credit. A June 2019 payments study from the San Francisco Fed did indeed list debit as the most popular payments instrument or the western U.S., at 28%. Credit cards were not far behind, at 23%. Finke also noted a problem for mobile is merchant intransigence. “Merchant services haven’t quite caught up to the tech in their customers’ pockets, or merchants aren’t willing to pay for the service.”

Neeraj Thakur, of the distributed finance network Difitek, chose bitcoin, as did bitcon developer Jon Atack, though Atack added that the implementation would take place via second-layer Lightning network apps. The Lightning network sits atop the bitcoin network (and other cruptocurrencies) in order to enable faster transactions and solve bitcoin’s scaling problem.

Most other recipients chose mobile, a sure sign of confidence in Apple Pay and other mobile payments forms from handset providers, but payments aficionado Gil R. Glover is looking for a more secure solutions: “Ten years is a long time in fintech. Security is the big driver. Probably something using chip implants.”

Several other respondents echoed this choice of none of the above – saying “Face” or “no device at all.”

This brngs up the important point that mobile payments (indeed, payments generally) rest on authentication and identity. The better and more efficient the uthentication system, the better the payments system.

What’s your payment strategy for the next decade? Do you know what your customers expect? It might be worth a discussion.

Subscribe to CCG Insights.