Facebook Announces Cryptocurrency Libra and Ambitions to Get into Lending

Facebook today unveiled its long-awaited cryptocurrency, named Libra, and announced its network of partners. The list includes important names from the payments space, such as Visa, Mastercard, PayPal, and Stripe; the rideshare companies Uber and Lyft; several important venture capital groups, including Andreessen Horowitz, Union Square Ventures, Thrive Capital and Ribbit Capital; and the cryptocurrency exchange Coinbase – but no banks.

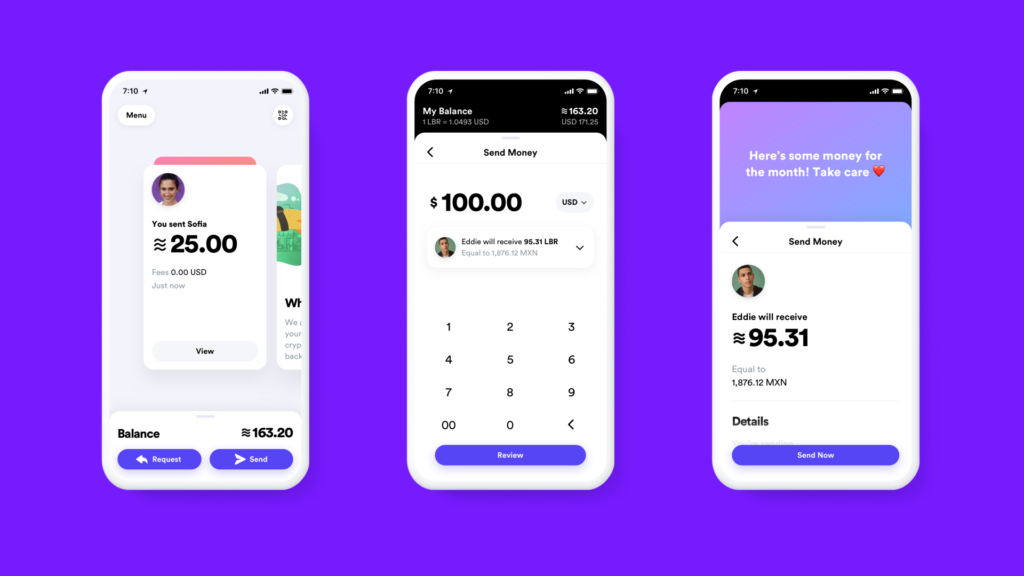

The cryptocurrency, which is a so-called stablecoin pegged to a pool of global currencies, will be run by Facebook’s newly announced subsidiary, Calibra, and will launch in 2020, according to a post from Facebook. The goal of Calibra is to “provide financial services that will let people access and participate in the Libra network,” according to the post. Calibra’s first product will be a digital wallet, available as a standalone app, as well is in Messenger and WhatsApp.

Future use cases could include lending and investing, according to Facebook.

This is not Facebook’s first time at the payments rodeo — several years ago the social network launched Credits for payments in Facebook games, and Mark Zuckerberg has been quoted as saying sending money should be as simple as sending photos.

Libra will bring financial inclusion to the may people around the globe who lack such access, Facebook noted: “The cost of that exclusion is high — approximately 70% of small businesses in developing countries lack access to credit and $25 billion is lost by migrants every year through remittance fees.”

Facebook has been working on Libra for more than a year, and the world, particularly the cryptocurrency world, have speculated widely on what the social network planned. Now we know. “It feels like it is time for a better system,” David Marcus, head of Facebook’s blockchain technology research, said in an interview with the New York Times. “This is something that could be a profound change for the entire world.”

The Libra blockchain will be closed at first, managed by the founding partners, and gradually open up as the service gains traction (and achieves world domination?) Facebook does not own Lbra, but instead has one vote vote as a founding member of the consortium administering Libra, along with Visa, Uber, and the other founding members, all of whom contributed money to the effort.

Facebook emphasized privacy and trust in its announcement, two words that few today associate with the company except in the negative. There will be a wall between targeted advertising and your Libra activity, the company says, but can social information be leveraged (with permission) to enable lending in countries with no established credit reporting? This has been done by companies such as Lenddo that have vastly less data than Facebook. The past twelve months, while Libra has been in development, have been an ongoing public relations disaster for Facebook, yet the service has continued to grow in users and revenue.

Now Zuckerberg and co. claim they can help U.S. businesses reach developing markets, and serve the consumers in those markets as well. Facebook surely reached out to JPMorgan Chase, Bank of America, Wells Fargo, and other banks, but Facebook and cryptocurrency may be the two things banks are least likely to want to put their brand alongside. With Facebook’s ambitions now tilting perilously close to banking, that may soon change.

The Zodiac symbol Libra is represented by the scales of justice. Here’s Libra’s horoscope for June 18, 2019 from Astrology.com: “The people around you are going to be full of energy today—and just this once, you might be lagging a bit behind the crowd. To catch up, grab onto someone’s coattails (with her or his permission, of course) and pull yourself along until you can muster up the energy to maintain your momentum on your own. Everyone is in this together, and they want you with them—so no one is going to mind if you need help catching up right now.”

Subscribe to CCG Insights.