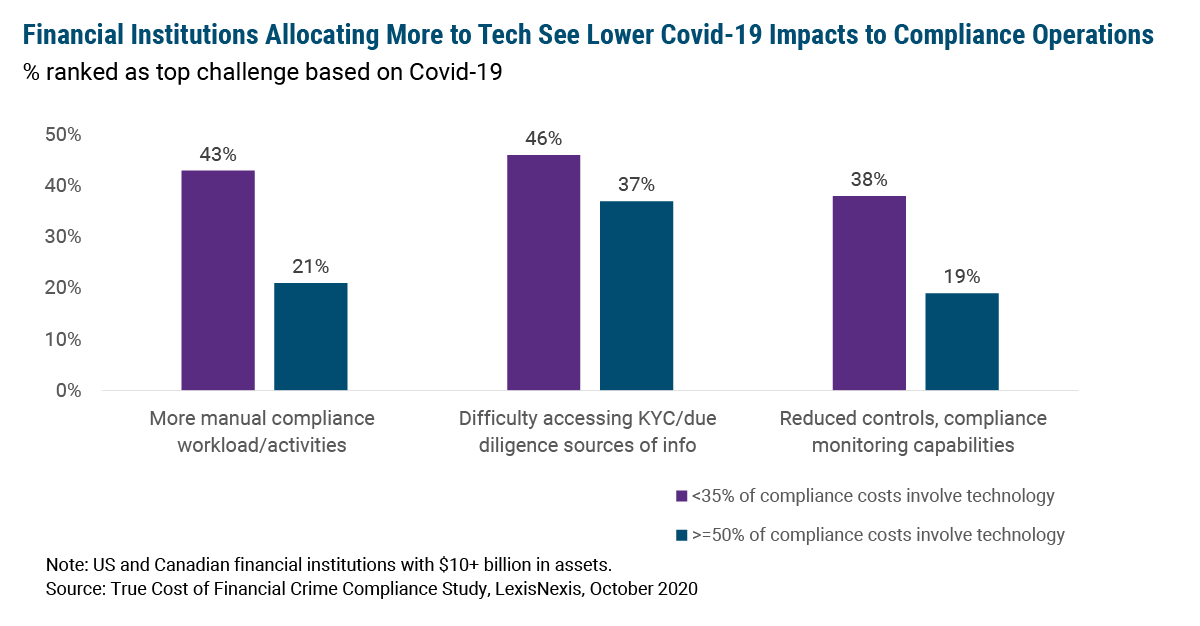

New data from LexisNexis shows that financial institutions (FIs) allocating 50% or more of their compliance costs to technology are seeing less disruption from Covid-19 than their peers. Specifically, while 43% of FIs allocating less than 35% of compliance costs to technology cited more manual compliance workloads/activities as a top challenge during the pandemic, the same was true for only 21% of those in the 50% or higher group. Lower technology spenders also faced more difficulty assessing KYC/due diligence sources of information and greater challenges related to reduced controls and compliance monitoring capabilities. The study surveyed 150 executives in the US and Canada who oversee financial crime compliance processes at banks, investment firms, asset management firms, and insurance companies; this portion of the study focused on larger FIs with $10+ billion in assets.

Compliance costs overall have skyrocketed during the pandemic. Among US and Canadian FIs, the total projected cost of financial crime compliance in 2020 is $42 billion, up 33% from $31.5 billion last year, per the report. Meanwhile, the average annual cost of financial crime compliance per organization is up 55%. A chaotic environment, like in a pandemic, is a breeding ground for financial crime, and FIs have been forced to dedicate additional resources to keep up with higher volumes of activity. However, it’s clear that those who’ve made technology a key part of their compliance approach are faring better than others. In addition to experiencing less severe challenges, their costs are also much lower — average annual compliance costs for those in the lower technology spend group are expected to hit $23.7 million in 2020 versus $18.7 million for those allocating more of their compliance costs to tech.

Financial firms can often be reluctant to shell out big bucks on technology, especially new technology, and especially when the old ways of doing things are more or less sufficient. Among FIs recently surveyed by Thomson Reuters that had not yet deployed fintech or regtech solutions, a third said it was due to lack of investment/budget, by far the most-cited reason. The LexisNexis report suggests this might be a mistake, as those using technology in their compliance operations actually seem to be spending less on compliance overall. Moreover, they seem much better positioned to weather this pandemic, which means they are also likely better placed for the future. Perhaps it’s time to rethink how we approach technology spend, with a crisper focus on ROI across different scenarios. If this pandemic has taught us anything, it’s that planning for more of the same is an extremely risky strategy.