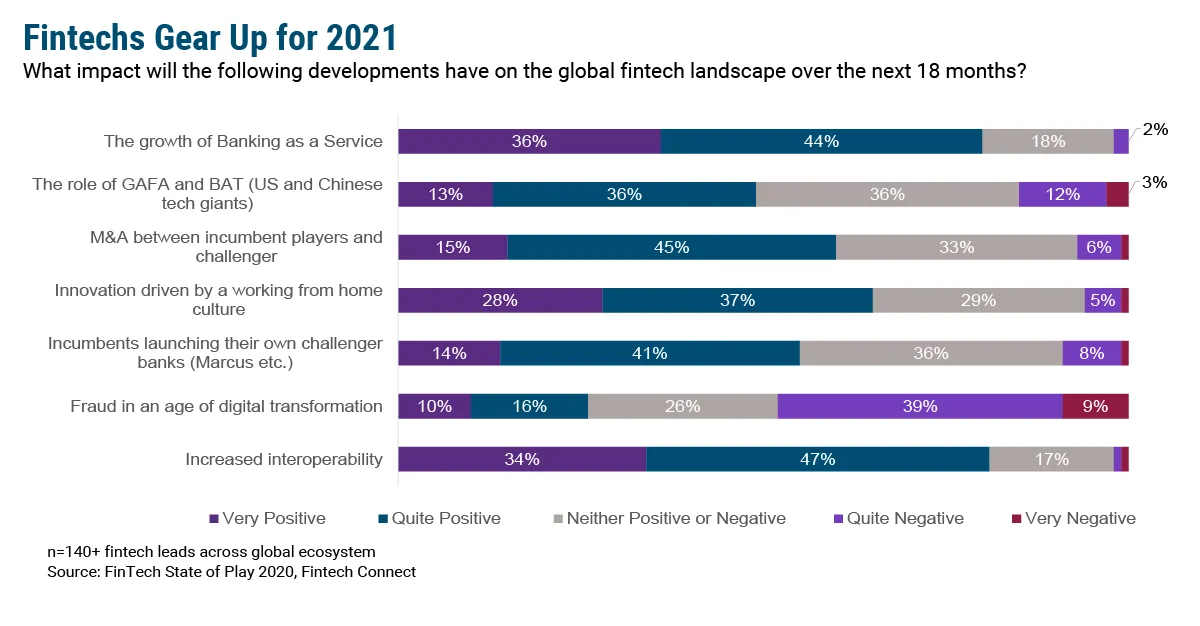

Let’s be honest, as we head into 2021, we’re all tracking the same big trends. Banking-as-a-Service (BaaS), of course, springs to mind, along with open APIs, tech giants coming for everyone, and the future of remote work — just to name a few. But, which of these is set to have the greatest positive impact in the year ahead? New data from Fintech Connect, which surveyed 140+ fintech leads globally in Q4 2020, including at fintechs and traditional financial institutions (FIs), attempts to tell us the answer.

Interoperability is the winner here — more respondents believe this trend toward flexible, API-first architectures will have a positive impact than any other category asked about. Specifically, a whopping 81% said it will have either a very positive or quite positive effect on the global fintech landscape in the next 18 months. BaaS, meanwhile, is a close second, with 80% predicting an overall positive impact. This isn’t surprising, as the former is a key ingredient for the latter. Put another way, BaaS is one of the things you can do if you have a flexible tech stack that supports interoperability.

BaaS, which refers to deploying traditional banking products through third parties, like fintechs and nonfinancial firms, is unarguably hot right now. The reason for this is likely because it benefits all members of the ecosystem: traditional FIs, the producers; fintechs or brands, the distributors; and customers, the users. The most common example of this is when a bank licenses its charter to allow a neobank to provide deposit accounts. US neobank Chime, for example, is powered by The Bancorp Bank and Stride Bank. But other use cases are emerging rapidly, especially in the business-to-business (B2B) space. Payments giant Stripe recently made headlines when it announced its BaaS platform, Stripe Treasury, aimed at allowing its clients to provide financial services. Shopify, for example, is using Stripe Treasury to build Shopify Balance, which will offer merchants on its e-commerce platform financial products.

On the banking side, the allure of BaaS is the ability to increase distribution through new channels without owning the customer experience or acquisition efforts. Community banks, in particular, have done a great job of capitalizing on this trend as many realized their exemption from the Durbin Amendment would allow them to make money on interchange fees as fintech users got to swiping. However, banks that have not yet solved for interoperability, meaning they cannot deploy bank functionality easily via API, risk being left out of this movement. This is the critical piece that will open the door not only to BaaS, but also to other kinds of third-party integration that enable the use of cutting-edge technology solutions internally as well the ability to rapidly deploy new products to customers. There’s a huge swathe of possibilities, and more likely on the way, but the first step is assessing your technology position and getting your house in order. Otherwise, it’ll just be popcorn on the sidelines.