Wells Fargo: New Logo Can’t Mask Same Old Technology

In late January, Wells Fargo announced a refreshed logo and new branding campaign in an attempt to move past the scandals and disappointments of recent years.

“Our company’s transformation continues,” said Tim Sloan, Wells Fargo’s CEO and president, in a Jan 24 press release announcing the campaign launch. “Our goal of delivering exceptional service to customers and helping them succeed financially remains central to everything we do. As customer expectations continue to evolve, this campaign highlights that Wells Fargo is transforming to provide easier, more personal and helpful solutions.”

Unfortunately, the bank’s transformation did not seem to include its technology operations. On Feb. 8, two weeks after the new campaign began, Wells Fargo suffered a major service outage stemming from smoke in a Minnesota data center. Customers found themselves unable to access funds, particularly direct deposits due to land in their accounts on Friday.

In other words, not much has changed other than the logo, and this new brand attribute won’t do much to change the minds of customers who were hurt by the bank’s poor decisions in recent years.

Wells Fargo will get through this, but clearly needs help. We know better than most that every bank could use some advice now and then – it’s what we do.

Trust is more than what customers feel about a brand, trust is about providing products, services and customer service that improve the customer’s life. When a customer puts their money into your bank, this action is a form of trust. But truth is a hard pill to swallow. The truth is Wells Fargo failed again to gain the trust of their customers. Wells Fargo can’t catch a break. On the heels of its new brand launch, Wells Fargo’s outage must seem to bank executives like a case of bad luck.

But this is the second outage this year for Wells Fargo, which may make consumers wonder whether the bank’s technology infrastructure is crumbling along with its brand reputation. The combination of failing technology and reputation is a serious quagmire – customers are justified in feeling outrage over the outage. Wells Fargo failed their customers by not planning for their customers’ future needs. (See Sloan’s brand promise above.)

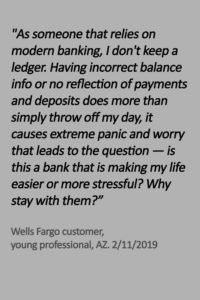

Other customers become frustrated when they did not get their paycheck and called out their employers, accusing them of forgetfulness. Customers who deposited cash did not see their deposits credited to their account, and customers who needed to pay their bills were unable to do so. This is catastrophic for the trust that must underlie a banking relationship.

The debacle began early Thursday morning, February 7. Customers complained of problems with online and mobile banking, downed ATMs, and declined debit cards. Wells Fargo used social media to inform customers about issues with their banking systems and on Twitter they incurred roughly 8,000 tweets across 9 posts. Fed-up customers were not shy about tweeting they are opening or intend to open bank accounts with competitors. As of February 12, Wells Fargo continues to try to calm stressed customers, some customers still complaining they cannot use their accounts.

Only 5 months ago, CCG Catalyst published the study, “Why customers switch their bank or credit union,” and among the banks mentioned prominently is Wells Fargo, which 26% of the respondents had left for another bank or credit union. Bank customers described their reasons for leaving Wells Fargo. They discussed the reputation, untrustworthiness and ethical issues in 33.3% of the comments, and other comments discussed poor customer service. Customers are forgiving if they believe in and trust the brand, but Wells Fargo has a long way to go to recovering its reputation and building trust with customers. This recent outage, triggering customers into fight or flight mode, will not help.

In our findings, 55% of customers indicated a willingness to leave a national bank. A slightly larger percentage of respondents (28%) left Bank of America than Wells Fargo, but there was a more telling difference. There were no comments from former Bank of America customers about the bank being untrustworthy, dishonest or unethical. When customers were asked about their experience with a national bank they had left, 80% of former Citibank customers cited being treated like a number. When asked what bank they switched to, only 7% of respondents moved to Wells Fargo from another bank or credit union.

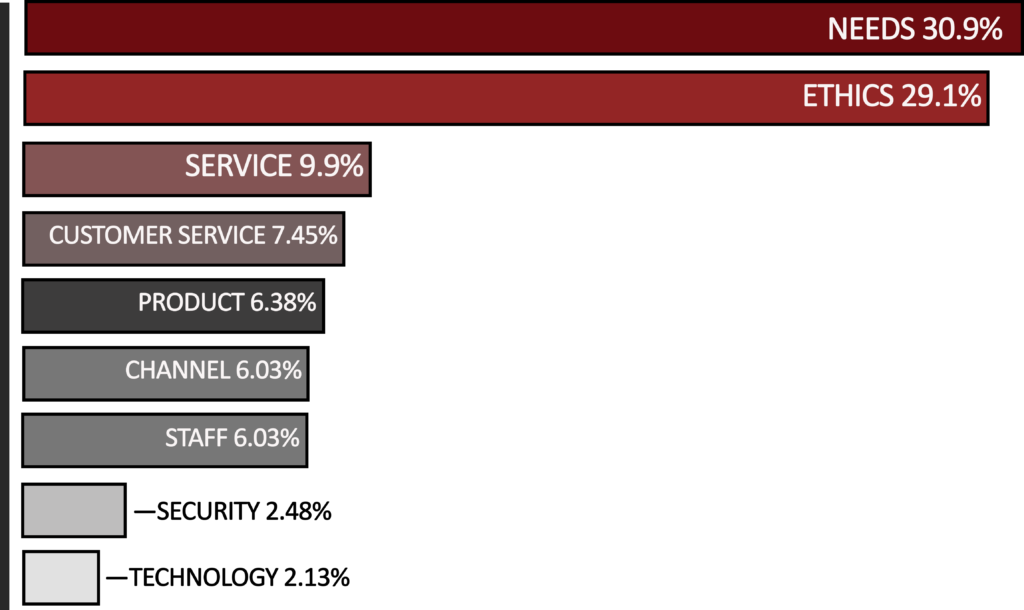

When analyzing customer trigger points, the greatest triggers for leaving their bank are needs (30%) and ethics (29%). Most customers understand technology has glitches, but the exception is when mistrust is already prevalent being compassionate is less likely.

In the case of the Wells Fargo outage, it was discovered that the problem originated in a single data center. Shutting down the system should have automatically rerouted transactions, but there were problems that upended connections, resulting in 48 hours of interrupted service for many customers.

“Banks for decades have been very good at backup systems and procedures for their core systems in case of an event at a data center. If a branch were to go down, tellers can still perform transactions held for movement later. As we move further into the digital age, with transactions originating from many more sources and form factors, this event is a wakeup call to analyze the preservation of transactions at all points of entry in the case of an outage event”. – Mark La Penta, CCG Catalyst

Well Fargo has online business continuity planning and a redundant system with two geographic locations, but still has work to do. Setting aside arrogance, it is important when putting in place contingency plans to account for the unforeseen. The contingency planning accounts for “what if” situations. This type of planning runs simulations that account for disruptions in banking business. Part of the scenarios should account for the disruptions that customers will face when an entire system is shut down for two days. Having such a plan in place will garner customers to feel safe and secure with your bank, and knowing you got their back.

Letting customers know such a system is in place – and customers seeing an uninterrupted stretch of solid service — is far more important than adjusting a logo or refreshing a brand.

Tery Spataro, EVP, Director of Research & Insights

Tery Spataro, EVP, Director of Research & Insights

marketing@ccg-catalyst.com

1.800.439.8710

Subscribe to CCG Insights.

Tery Spataro, EVP, Director of Research & Insights

Tery Spataro, EVP, Director of Research & Insights