Circle(s) of Trust in Financial Services

December 26, 2022

The “Circle of Trust” was a concept introduced in the Fall of 2000 which, admittedly, was explored in a film with no relation to banking or financial services. Notwithstanding its origin, when applying the concept of the Circle of Trust (or, for our purposes, Circles of Trust) to financial services, one discovers that it can be fundamental in considering the relationships between financial institutions (FIs) and their various constituencies. The importance of trust and the concept of Circles of Trust has broad applicability to the essential and often overlapping relationships in financial services. In today’s world, one need not search for too long to find evidence of growing societal distrust permeating in areas such as politics, journalism, and financial services, or the failure of financial innovations (e.g., crypto) to eliminate the need for trust. We know that a significant factor of success in financial services, however, is often a product of effectively cultivating and maintaining trust. For example, statistics have shown that customers with greater trust in their primary FI utilize more products and services (e.g., additional accounts), are more likely to recommend the FI, and prefer the FI’s brand over competitors. With that in mind, FIs ought to be formulating strategies focused on establishing and maintaining their Circles of Trust.

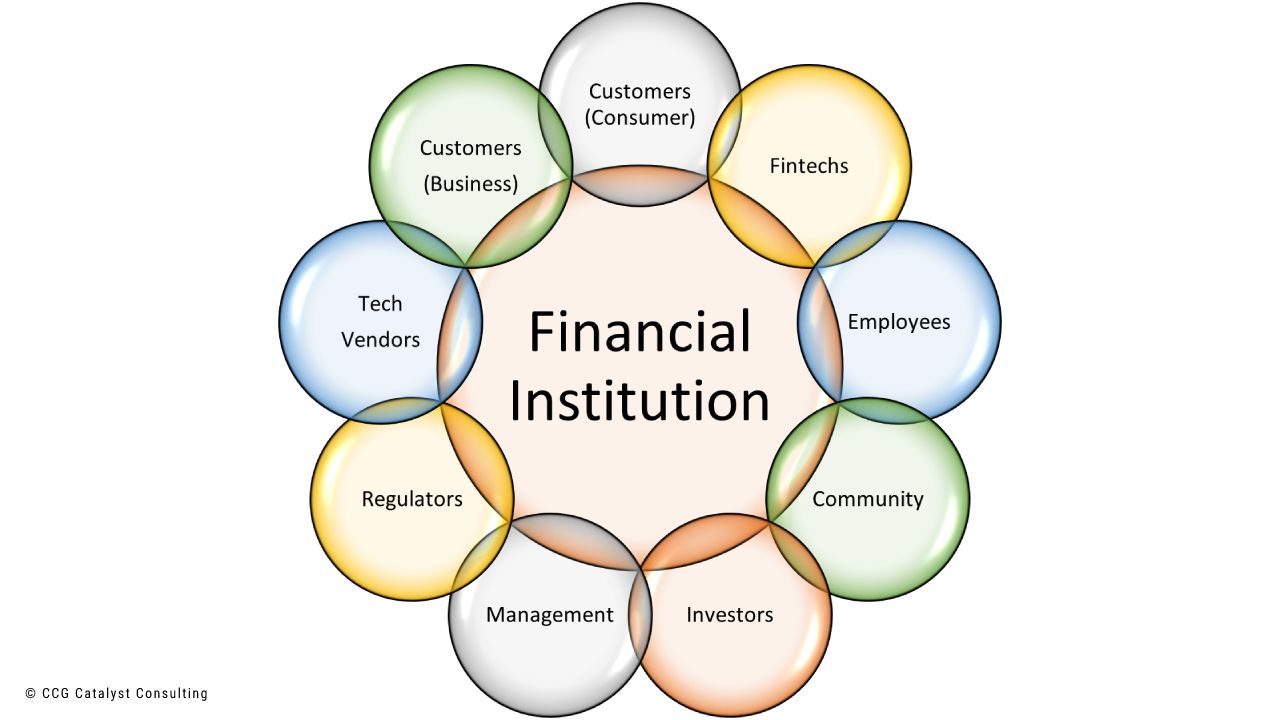

Circles of Trust for FIs include customers (business and consumer), employees, regulators, fintechs, management, investors, communities, and technology vendors, among others. While each of these constituencies merit ample consideration by FIs on an individual basis, there is often an implicit and/or explicit interplay amongst the different constituencies. Regulators, for instance, are mandated to oversee FIs and their relationships with consumers, which, in turn, may take the form of enhanced supervision over FI-fintech relationships. FIs create an incentivized relationship with some employees to establish and grow relationships with consumers. Fintechs bring solutions to FIs to manage relationships with consumers, employees, and regulators. The examples of interplay go on and on. Further, the relevant Circles of Trust may not be the same for each FI, so identifying and catering to the Circles of Trust most relevant to your FI should be a critical part of your strategy.

Underpinning each of these interrelated and potentially dependent relationships, however, is trust (or the lack thereof). Although regulators in the United States grant special business licenses to FIs in the form of a bank charter, regulators still trust that FIs will operate appropriately. Similarly, most consumers expect FIs will fund loans and return deposit dollars based on trust. Of course, legal constructs are in place (e.g., contracts and deposit insurance) and enforcement mechanisms exist (consumers leave FIs, FIs fire employees, regulators punish FIs for infractions, etc.). But laws and enforcement mechanisms can only supplement the trust in these relationships, they cannot replace it.

FIs that nurture their various Circles of Trust and recognize how they are intertwined will be better positioned to achieve success through those interrelated relationships. FIs that can demonstrate trust with their regulators, for example, will be more effective in attracting strong fintech partners that understand the importance of regulatory cooperation. FIs exhibiting more trust with customers will be more appealing to investors and less likely to warrant scrutiny from regulators. The converse is also true.

Creating, maintaining, and fostering continued trust with its many constituencies ought to be a foundational element of every FI’s strategy. Similarly, FIs need to development and implement a strategy that avoids focusing on one constituency so narrowly at the risk of alienating one or multiple others, considering them all individually as well as collectively. While the pendulum may swing from one constituency to another depending on an array of factors, FIs need to continually recognize the importance and interrelated nature of developing trust across all constituencies. If FIs are intent on

gaining a competitive advantage through trust, then they should focus on building strategies that establish their Circles of Trust.